-

QROPS FACTS

- May 7, 2015

- Posted by: Graeme Callaghan

- Categories: News, QROPS

No Comments

-

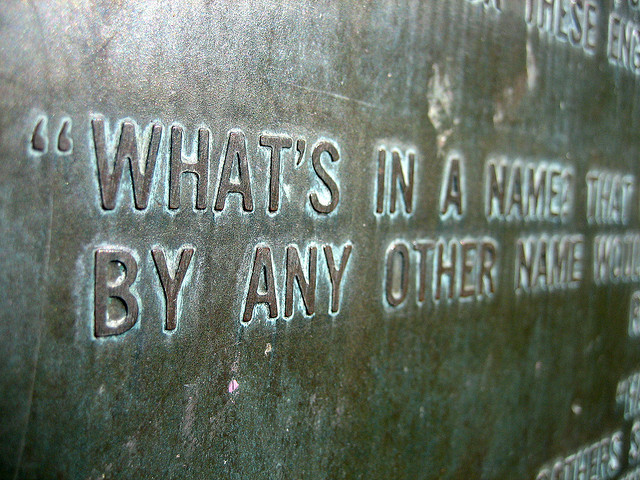

QROPS now ROPS

- May 6, 2015

- Posted by: Graeme Callaghan

- Categories: News, QROPS

-

HMRC QROPS List

- April 22, 2015

- Posted by: Graeme Callaghan

- Categories: News, QROPS

-

QROPS Malta Changes

- April 22, 2015

- Posted by: Graeme Callaghan

- Categories: News, QROPS

-

The Benefits of a QROPS Vs. A UK-based Pension Scheme

- March 5, 2015

- Posted by: admin

- Categories: Investment, QROPS, Retirement

- 1

- 2