- May 6, 2015

- Posted by: Graeme Callaghan

- Categories: News, QROPS

In our previous article ‘HMRC QROPS List’ we stated that as of 15 April 2015 the word “qualifying” from Qualifying Recognised Overseas Pension Schemes (QROPS) had been removed from HMRC QROPS list and now referred only to as ROPS (Recognised Overseas Pension Schemes).

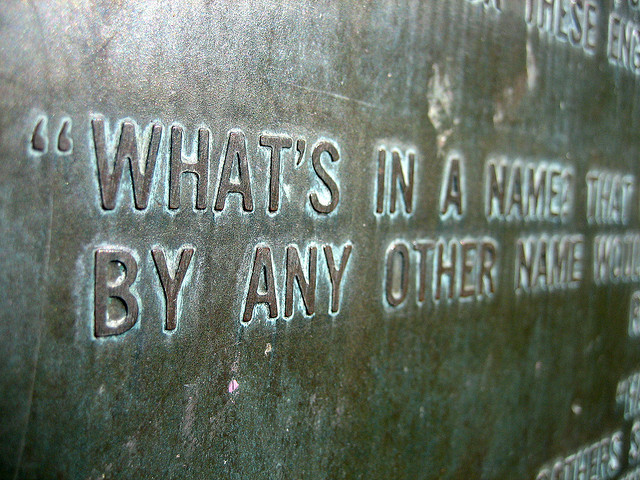

If you speak to anyone who has left (or thinking of leaving) the UK to emigrate permanently and had built up a pension fund, many will be aware of the name QROPS. The QROPS program was launched on 6 April 2006 as a part of new legislation with the objective of simplifying pensions, and since then QROPS has become a household name.

The fact that the list is not qualified has always been the case and is nothing new. HMRC QROPS (or now ROPS) list had always been self certified with HMRC specifically not endorsing or recommending any scheme’s suitability.

HMRC Explanation of a ROPS.

According to HMRC a ROPS is still QROPS if:

(a) the scheme manager has given to the Inland Revenue notification that it is a ROPS and has provided any such evidence that it is a ROPS as the Inland Revenue may require;

(b) the scheme manager has undertaken to the Inland Revenue to inform the Inland Revenue if it ceases to be a ROPS;

(c) the scheme manager has undertaken to the Inland Revenue to comply with any prescribed information requirements imposed on the scheme manager; and

(d) the ROPS is not excluded from being a QROPS by subsection (5).

A ROPS is excluded from being a QROPS by this subsection if the Inland Revenue has decided that—

(a) there has been a failure to comply with any prescribed information requirements imposed on the scheme manager and the failure is significant; and

(b) by reason of the failure it is not appropriate that transfers of sums or assets held for the purposes of, or representing accrued rights under, registered pension schemes so as to become held for the purposes of, or to represent rights under, the ROPS should be recognised transfers;

and has notified the person or persons appearing to be the scheme manager of that decision (but subject to subsection (7) and section 170).

So do not get confused if you start seeing ROPS being used in the media, financial and pension advisory companies. Despite QROPS being a popular acronym, it is now time to make ROPS the new ‘in’ word.

ROPS Advice

If you would like information about ROPS, call us on +34 698 243 745 or Contact Us Today

GC QROPS has been successfully assisting UK expats in Spain with UK pension transfers for 9 years since 2006.

We are completely independent, and can advise on a wide variety of ROPS pension schemes – we are not tied to any single provider, which means that we will recommend the scheme which meets your exact requirements and needs.